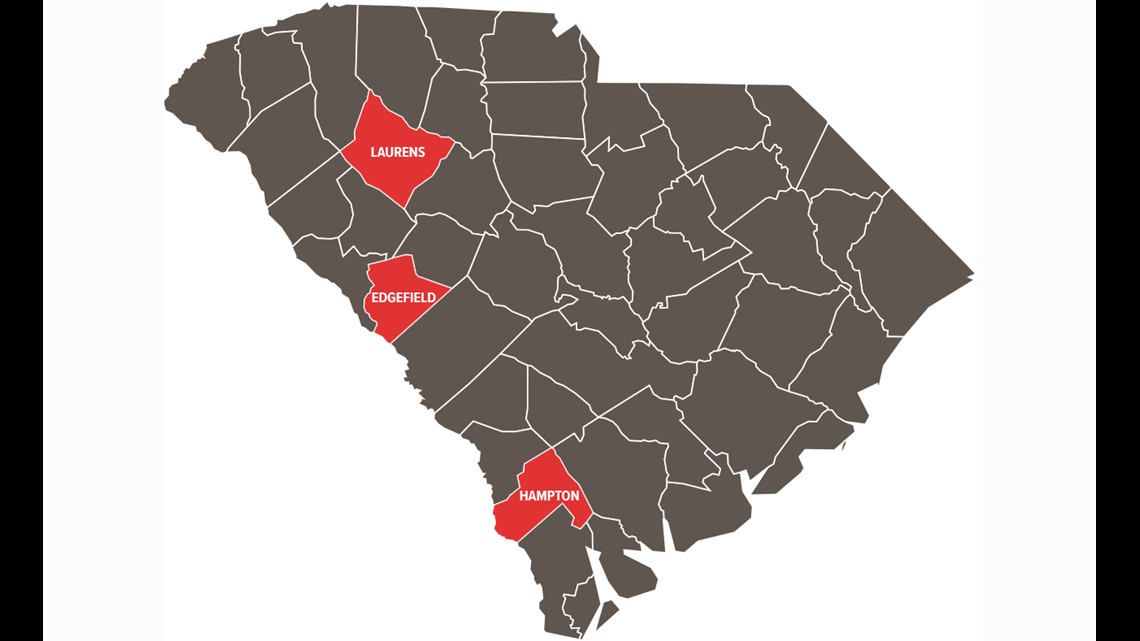

COLUMBIA, S.C. — The South Carolina Department of Revenue wants consumers to be aware local sales tax rates in three counties in South Carolina will change as of May 1, 2021.

In 2020, voters in Edgefield and Laurens Counties approved a temporary increase in order to pay for projects within the counties. The 1% Capital Project Sales Tax increase will be added to the counties' 1% Local Option Sales Tax for the next eight years, unless voters approve another referendum. Those paying an Accommodations Tax in either county will pay 9% beginning May 1.

The taxes do NOT apply to sales of unprepared food.

In Edgefield County, the tax increase should raise approximately $10 million to pay for the construction of a new law enforcement center, including a new detention facility.

In Laurens County, the tax increase will raise about $35 million pay for 16 projects, including improvements at the Clinton Regional Library, the county's agricultural and business center, and the Laurens County Water and Sewer Commission Water Tower.

In Hampton County, the Capital Project Sales Tax time period that began in 2013 ends on May 1. Local sales taxes in Hampton County will drop to 7%.