WASHINGTON — The Biden administration on Wednesday announced a long-awaited plan to cancel up to $10,000 in federal student loan debt for millions of Americans and up to 20,000 for low-income borrowers.

An analysis earlier this week put the total cost of forgiving that debt at almost $300 billion in the first year, according to the Penn Wharton Budget Model, a group of economists and data scientists at the University of Pennsylvania who analyze public policy to assess their economic and fiscal impact.

However, economists at the Penn Wharton Budget Model are now updating their analysis, which was based on the assumption that up to $10,000 of forgiveness would be available to borrowers. But the White House added an unexpected twist by providing up to $20,000 of forgiveness for Pell Grant recipients, which wasn't calculated by the Penn Wharton Budget Model since the group analyzed the impact prior to Biden's announcement.

While the updated analysis wasn't complete as of Wednesday evening, the expanded loan relief will make the program more progressive while also more expensive, Penn Wharton told CBS MoneyWatch.

A boon for better off Americans?

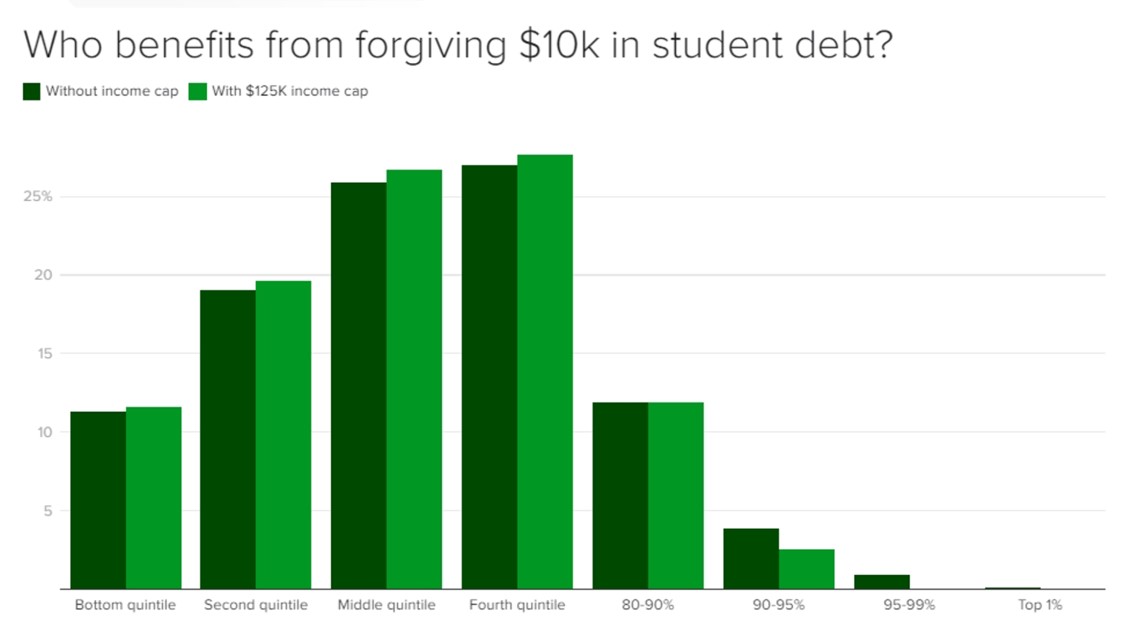

Based on relief of only $10,000 for borrowers, the benefit of erasing billions in college loans would mostly go toward Americans higher up the income ladder, the analysis also found. More than two-thirds of the debt forgiveness would help people in the top 60% of the income distribution — or those who earn $82,400 or more per year.

That could raise questions about the policy's fairness. According to the Federal Reserve Bank of St. Louis, median household income in the U.S. in 2020 was roughly $67,500.

For instance, some experts have raised concerns that forgiving student loans may effectively penalize people who already paid off their debt, often while making considerable financial sacrifices. A program offering mass debt forgiveness for college graduates also may be seen as benefiting more educated Americans, while offering nothing to those who didn't attend college.

College grads typically earn more than people with high school degrees — a boost that can amount to $1 million in additional income over the course of their careers compared with people without a bachelor's degree, one analysis found.

At the same time, college grads have been weighed down by their loans, with more than 40 million Americans holding a combined $1.7 trillion in debt. Those loans have taken a toll on the economy as they force many grads to delay major financial and life milestones, such as buying a home or starting a family.

Some consumer advocates and grads have argued that $10,000 in loan forgiveness is insufficient, noting that the average amount of debt held by grads is about $38,000.

Some policy experts have proposed forgiving up to $50,000, but that would be far more costly than wiping away $10,000, according to Penn Wharton's analysis. The price tag for the former would amount to $784 billion in the first year, assuming an income cap of $125,000.

The cost of running a debt-relief program would be incremental in following years, since the bulk of the forgiveness would occur in its initial year, according to Penn Wharton. For instance, under a plan to forgive $10,000 per debtor with a cap of $125,000 in income, the cost in the following year would be $3.7 billion.