NEW YORK — Zachary Lloyd makes $14,800 a year as a graduate teaching assistant at Florida State University — right around the poverty line for a single adult. So the 25-year-old was looking forward to a pay increase starting this fall that would net him about $1,000 more, just about covering his higher costs for groceries, fast food and gasoline.

Then his lease came up for renewal, and Lloyd learned his management company was raising the rent on the Tallahassee apartment he shares with a fellow student by $250 a month.

"I was shocked when I opened the letter today — it was almost 18%, which is not covered by a pay raise," he told CBS MoneyWatch.

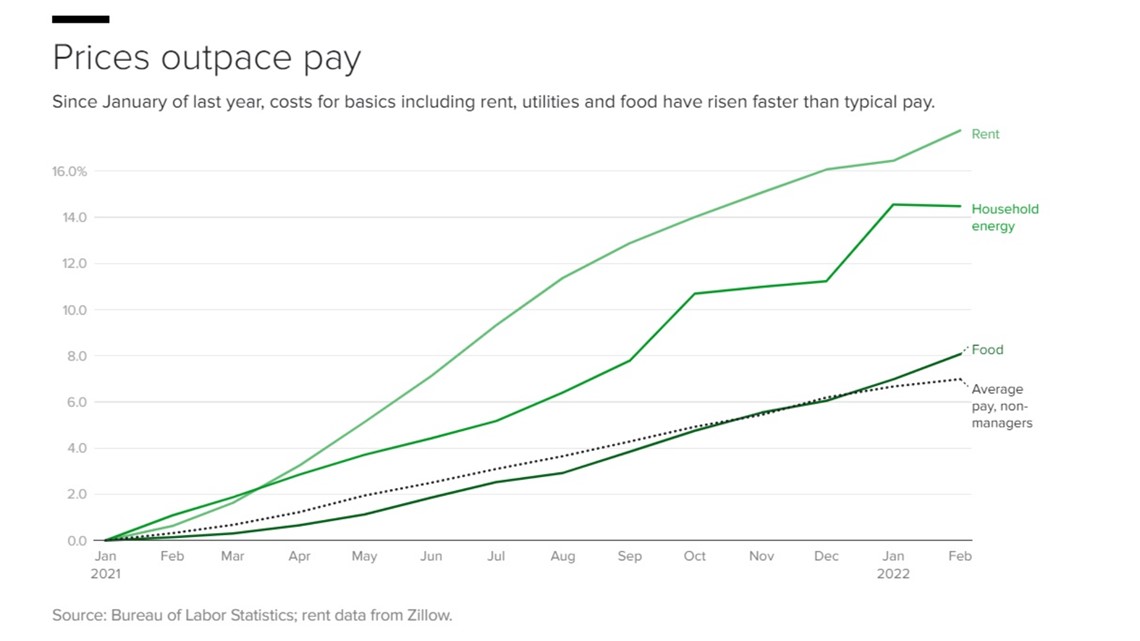

Lloyd is facing a dilemma distressingly common among America's 120 million renters. With the cost of rent, transportation and utilities all rising at double-digits, many households are forking over last year's pay increases, and then some, just to make ends meet.

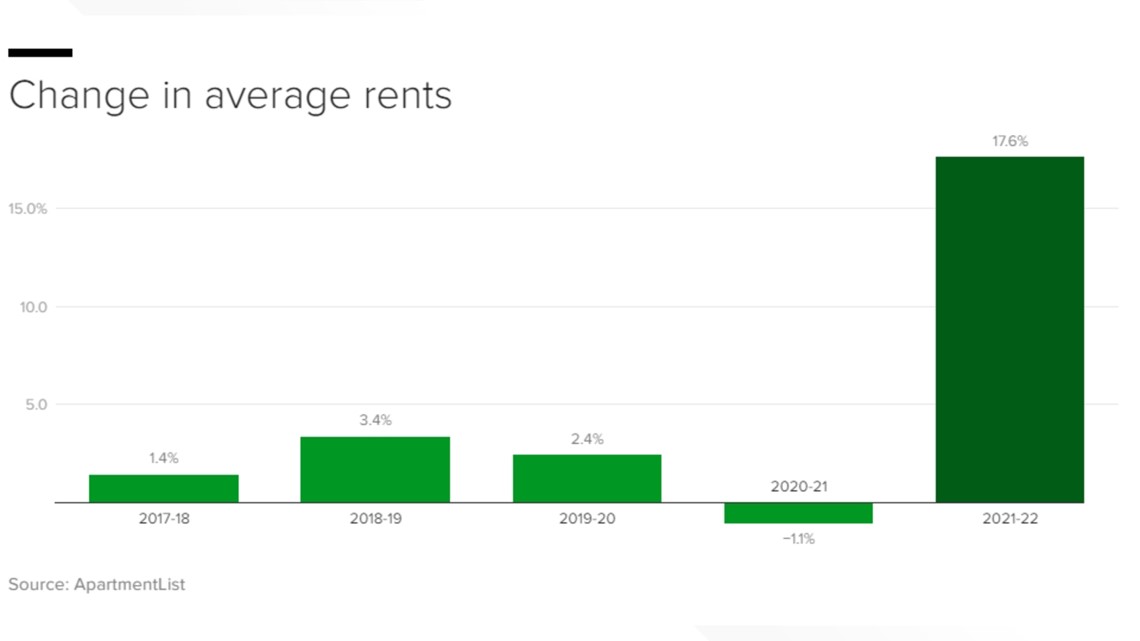

The median rent around the U.S. reached a record high $1,792 last month, according to Realtor.com — a 17% jump from the previous year and the 10th month in a row rents had increased by double-digits. In 14 U.S. cities, the typical rent is no longer affordable, far surpassing the 30% of income that personal-finance experts recommend as a maximum.

Lloyd is already facing the prospect of buying health insurance for the first time when he turns 26 in July and will leave his parents' plan. The added costs from rent are making him consider getting a second job — made difficult by his full-time schedule of teaching and classes — or taking out student loans to cover the difference.

"It's a tight pickle at the moment," said Lloyd, who started searching for a new place minutes after getting his landlord's email — only to find even higher apartment rents elsewhere. He considers himself lucky that his undergraduate degree saddled him with less than $50,000 in debt. "I wasn't planning to take out any more loans, but we're here."

Shocked by the electric bill

The cost of heat, power and transportation are all shooting up, too. Gasoline prices are up nearly 50% from last year, while the cost of utilities like heat and electricity is up 15%. In New York this winter, hundreds of residents were shocked to see power bills in the hundreds of dollars, sometimes triple their usual amount.

Queens resident Alex Rivas thought the $746 electric bill he received for January was a mistake. He reached out to a friend who had house-sat for him "to ask if he had started a Bitcoin mine or an illegal marijuana farm," Rivas told CBS New York.

"Heating oil has gone up 40% from this time last year. For a family that's living on the edge … that's a very big deal," said Will Fischer, senior director for housing policy and research at the Center on Budget and Policy Priorities.

The sharp increases are wiping out pay raises that many workers saw this year. Average hourly pay for production and non-supervisory workers — a group that encompasses the roughly 4 in 5 workers who aren't managers — is up 8% since the start of last year.

Many families won't have much wiggle room to deal with the higher prices because housing and transportation are the two biggest components of most household budgets, according to the Urban Institute.

"Rising rents could mean a higher likelihood of eviction. Rising gas prices could mean reduced or costlier access to employment, recreation, education and other needs," the Urban Institute noted in a recent analysis.

To be sure, housing has long been unaffordable for the poor. But the latest crunch, stemming from long-term trends in real estate along with more recent factors linked to the pandemic, is now putting a financial strain on most Americans. Many young people are moving out on their own after having shacked up with family during the pandemic, while record home purchases by investors and shortages of building materials are contributing to the housing crunch.

"A lot of people were on the edge already, and those numbers started going up last summer," said Fischer. "The supply and demand imbalances have gotten worse. The vacancy rates have tightened."

The CBPP is calling for the federal government to spend more on housing vouchers to help families pay their rent in the short-term while the supply of housing catches up with demand. In another move to lighten the load on consumers, some states are also suspending local gas taxes to ease the pain at the pump.

Energy costs have followed a similar trajectory to rents. When demand for gas fell during the pandemic, fossil-fuel companies mothballed much of their production capacity. But while driving quickly rebounded as the economy reopened, extraction companies have been loath to pump more despite the price of oil hitting historic levels. Even as gas prices have dropped from their recent record highs, Russia's ongoing war in Ukraine and the U.S. ban on Russian oil in response, threaten to keep those prices elevated for the indefinite future.

Concurrent price hikes for essentials like a home, food and heat make the typical trade-off often required of consumers — say, a longer commute for more affordable housing — that much harder. Lloyd, who drives himself to campus every day in a fuel-efficient Honda Civic, found that apartments within walking distance to his campus workplace have gotten even pricier than his current residence — negating any savings he'd gain from not driving. Even moving has a cost.

"Anytime we have to move, that means we have to rent trucks, and get movers, and pay the new signing fees and registration fees," he said.