COLUMBIA, S.C. — It's tax season and with that comes lots of documents.

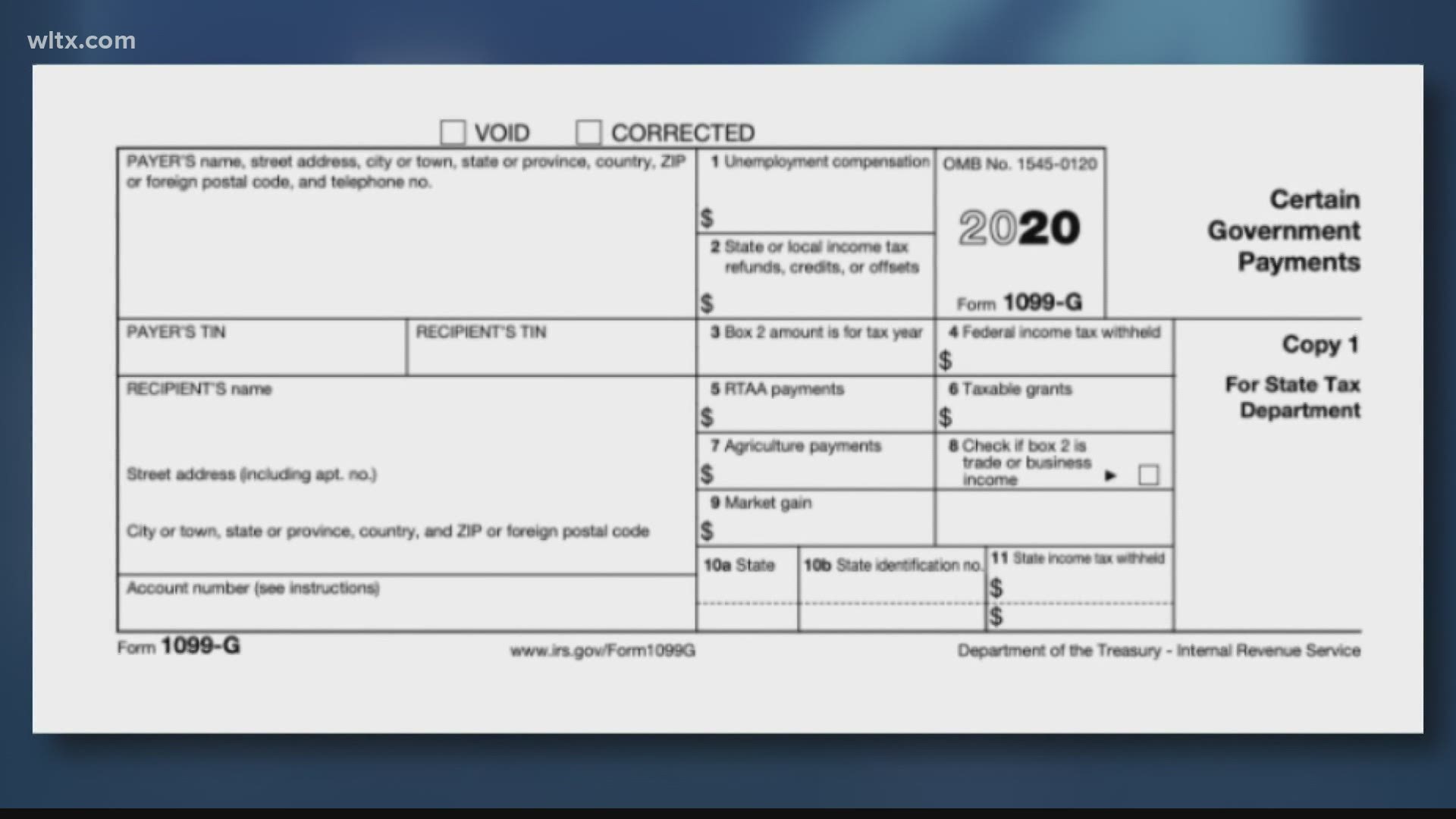

Last year, many folks had to file unemployment for the first time because of the pandemic. If you were one of those people, the South Carolina Department of Employment and Workforce (SCDEW) says to make sure you have your 1099-G form.

When filing for unemployment, there is the option to deduct taxes immediately or later on, but either way, you still need the 1099-G document.

To access it, you can log on to your unemployment benefit portal.

"As with anything, with documents we want you to review it," SCDEW Spokesperson Heather Biance said. "Go through the document, make sure based off the amount of money you received corresponds with what is on your 1099-G. Just double check. If, for some reason, there is a discrepancy or you think there is a discrepancy, you can dispute it and it will come through our system and we will review it and re-determine that with you."

SCDEW says it is important to remember, even if you were unemployed, you still have to file income taxes.