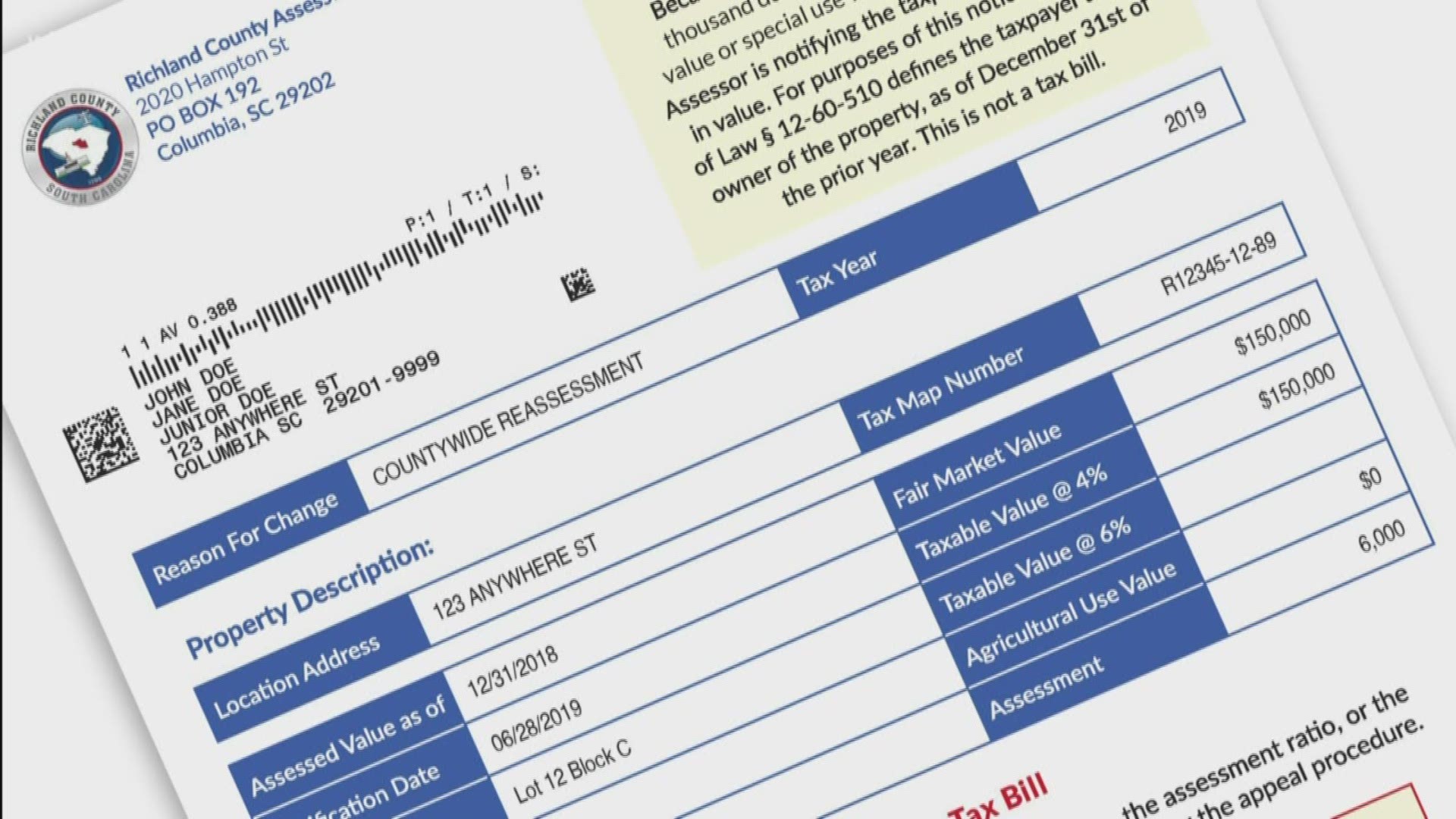

COLUMBIA, S.C. — The Richland County Assessor’s Division’s 2019 countywide property tax assessment has been completed. The reassessment is done every 5 years, in accordance with state law, to make sure that all real property is valued equitably and fairly.

Only those residents with properties that have an increase in value of $1,000 or more will receive a reassessment notice. Richland County has 173,700 parcels of real estate property and the Assessor’s Division sent out approximately 100,000 reassessment notices on July 2.

Assessment – the fair market price the property could sell for in the open real estate market – and taxes will not be calculated until October, when County Council sets the property tax rates (millage rate).

Fair market price changes are affected by desirability of the neighborhood, location and age of the property.

An increase in a home’s value does not necessarily mean an increase in taxes. In reassessment years, South Carolina state law requires counties to roll back millage rates to be revenue neutral. Any tax increases would be in effect the following year. About half of the property owners will benefit from a mandated 15% cap in taxable value.

Residents can visit County Assessor’s property tax estimate page to estimate their real property tax based on 2019 taxable value and 2018 millage rate. If you disagree with the fair market value, special use value, assessment ratio, or assessment of your property, you can appeal within 90 days of notification of assessment. Written objections must be filed with the Richland County Assessor by Sept. 26, 2019.

There will be two community meetings planed by the Assessor’s Division to give the public an overview of the reassessment process and a chance to ask general questions:

- 6 p.m. Tuesday, July 16, County Council Chambers, 2020 Hampton Street, Columbia

- Time and place to be determined in the Lower Richland community.