LEXINGTON, S.C. — According to data from last year's Internet Crime Complaint Center annual report, 277 South Carolinians fell victim to a romance scam, and lost over $11 million in the process.

The State Department of Consumer Affairs says, of those numbers, only 29 of these romance-related scams were reported to them. And as of this year, only three romance related scams have been reported.

The FBI tells News19 that folks need to do a lot more reporting if they suspect or were a victim of a scam.

"The amount of money that's lost towards the romance and the confidence fraud, those are the ones that we're seeing the most," Shelly Rodriguez, FBI special agent said.

Special agent Shelly Rodriguez said romantic-related fraud and scams are becoming an increasing threat here in South Carolina. The FBI division in the Midlands is hoping to lessen those numbers through education.

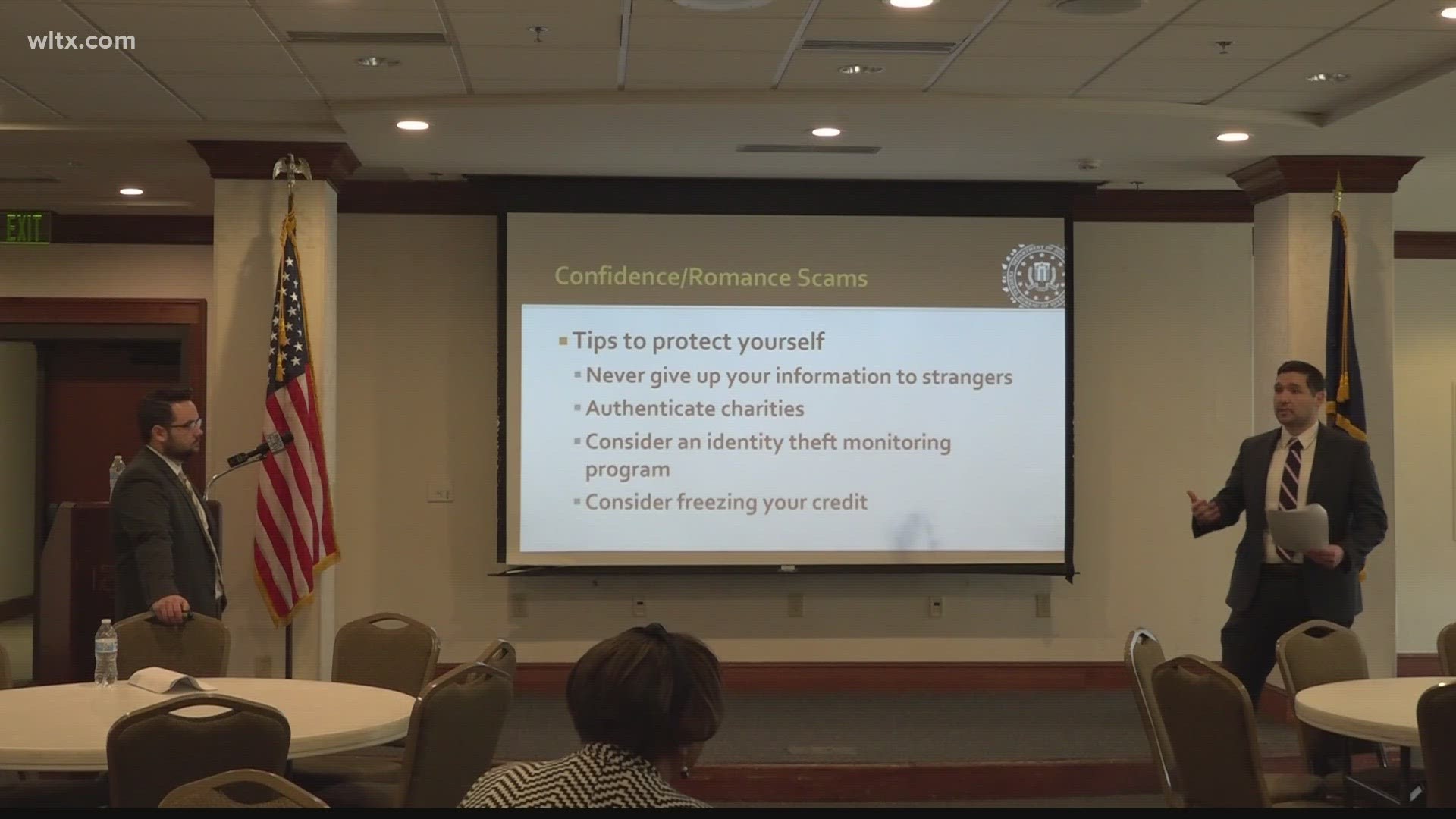

Representatives from the Lexington FBI division held a public information session Wednesday night in efforts to educate and prevent future scams.

This is something Sandra Shealy fell victim to about two years ago.

"I was contacted by someone on Facebook and it just went on from there. (I) developed a relationship and I found out in the end that I wasn't the only one he was dealing with because he actually had one of his other victims send me a check," Shealy said.

Shealy tells News19 she developed trust with this person through photographs and videos.

"He had a very elaborate scheme and I even saw him on Zoom," Shealy said.

She adds that, even today, she's still working to pay back the money she owes.

"I took out my annuity, so that was $11,000 in taxes. It came to about $85,000," Shealy said.

Rodriguez explains the frequency of internet use, comfortability and trust of buying and interacting online has made these scams take off and they need to be reported.

"With the romance fraud today, it's so much easier to create a fake persona and use AI technology," Rodriguez said.

To report a scam, go here or call 1-800-CALL-FBI.

The FBI says some ways you can protect yourself are by joining an identity theft monitoring program, considering freezing your credit, and to make sure to do your own fact checking to authenticate a business, bank or charity.