LEXINGTON COUNTY, S.C. — Lexington County Council voted Tuesday to indefinitely postpone a proposed $30 service fee on registered vehicles within the county following extensive discussion and significant opposition from residents and council members.

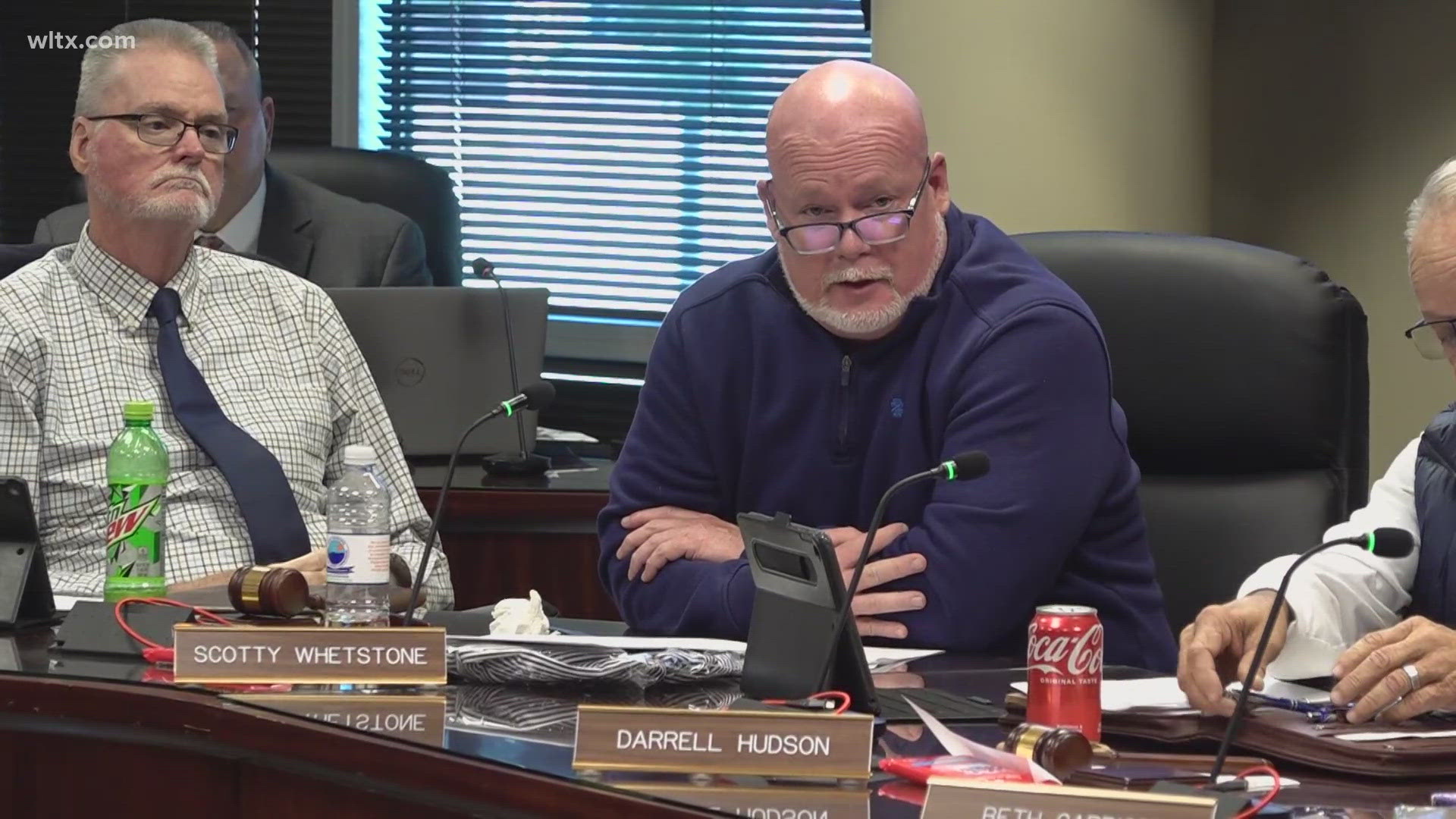

“My recommendation would be to postpone indefinitely and for y'all to start working on advertisement and marketing for the penny [sales tax] for two years from now,” said Lexington County Council Member Scotty Whetstone.

The council had introduced the vehicle fee as an alternative to the previously rejected penny tax to fund road and stormwater improvements.

Residents in the community have been pushing back on the fee since it was brought up.

“We do not need it, I think it would just be ridiculous; we’re already getting taxed to death,” said resident Elizabeth Garner.

Whetstone echoed the sentiment, saying, “I think this is the wrong time for this, and the constituents and the citizens of this county are fighting back against it.”

RELATED: Lexington County Council considers new annual service fee for residents with registered vehicles

Ultimately, council members voted to postpone the vehicle fee indefinitely.

Had it been approved, the service fee would have been directed toward road and stormwater maintenance, improvements, and construction projects across the county.

The council discussed three primary funding options: the previously rejected penny tax or the proposed $30 vehicle fee.

Council Member Debra Summers suggested allowing residents to choose between the two proposed funding solutions.

“Do you want the penny tax or do you want the vehicle fee? Give them a choice because guess what ... I get as many calls about roads still being in bad condition, so I'm getting more calls about that than I am the $30 fee,” Summers said. “People are still complaining about the roads so I mean looking forward to plan, if that doesn't work can we give the people a choice?"

In response to resident concerns over the use of tax dollars, Council Chairwoman Beth Carrigg says, "Your tax dollars don’t pay for road paving and resurfacing. That comes from the state gas tax."