BATESBURG-LEESVILLE, S.C. — Things are about to get easier for business owners looking to pay their business license fees.

Now, instead of several due dates, there will be one across the entire state. Instead of one system of profitability categories, there will now be a new one.

Starting January 1, 2022, everyone has to comply or the Municipal Association will be following up.

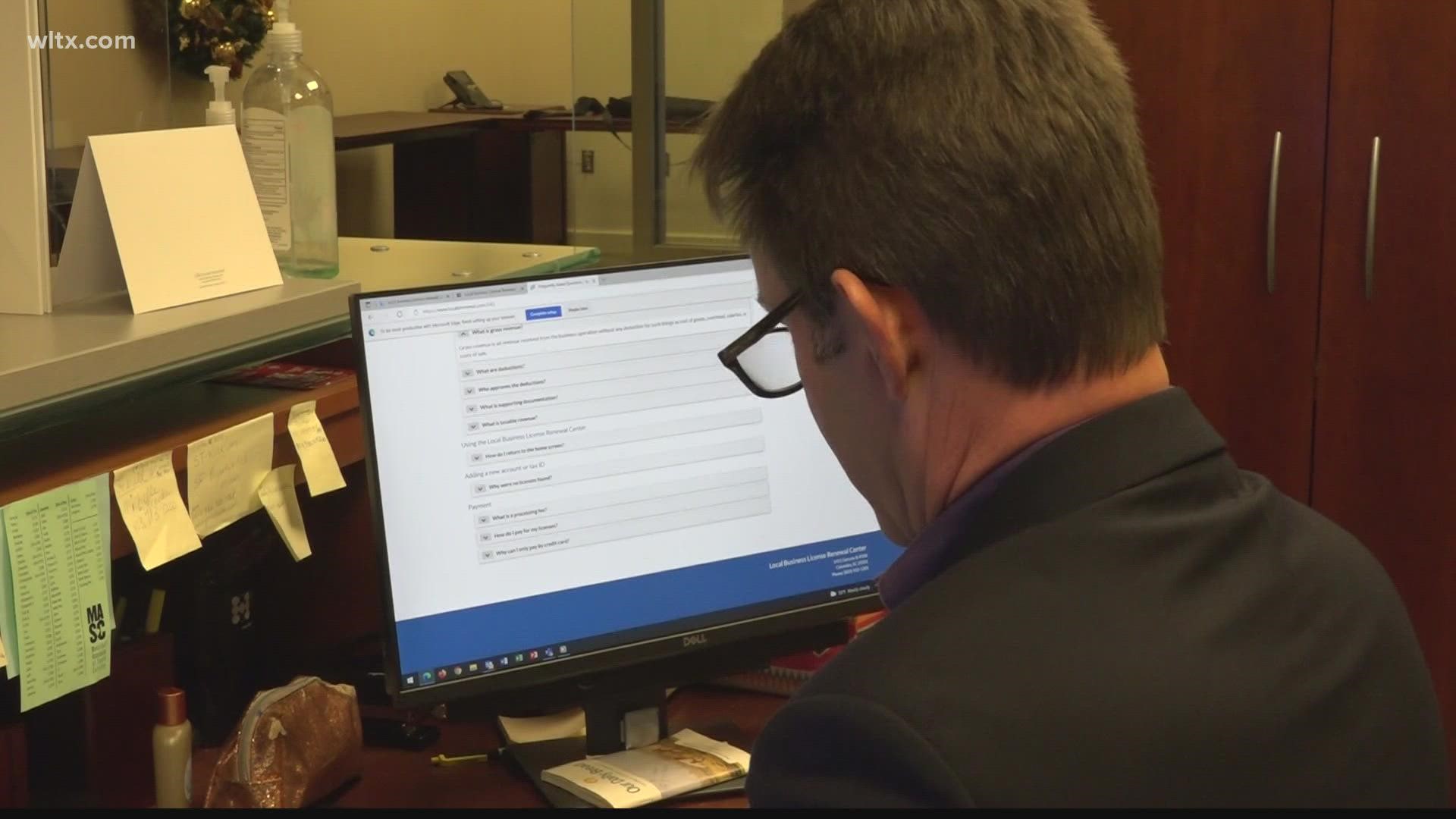

"If I do business in three different cities across the state, the due date for those taxes will be the same in every city across the state going forward and then I'll be able to pay all three of my business license taxes at that one portal, local business license renewal center, with one payment," said Scott Slatton, director of communications and advocacy for Municipal Association of South Carolina.

"Most of the problem that occurred over the years was too many different municipalities had many different ways of doing their business licensing," Batesburg-Leesville town manager Tedd Luckadoo said.

The state legislature had the option of getting rid of this tax altogether, but that would have meant less money for cities and towns to work with.

For example, Batesburg-Leesville brings in about $1M in business licensing fees each year, which accounts for 30% of their general fund.

So instead, lawmakers went with this streamlining option.

"I think we have some on the restaurant side that pay us a business license here, but they also go in and cater into other communities and they may have to pay business licenses in those communities. But for the most part, our local businesses are primarily paying a business license just here in Batesburg-Leesville," Luckadoo said.

Today, about 215 of the 230 municipalities in the state have changed to the new system and the rest will follow soon.

It's out with the old tax form and in with the new.