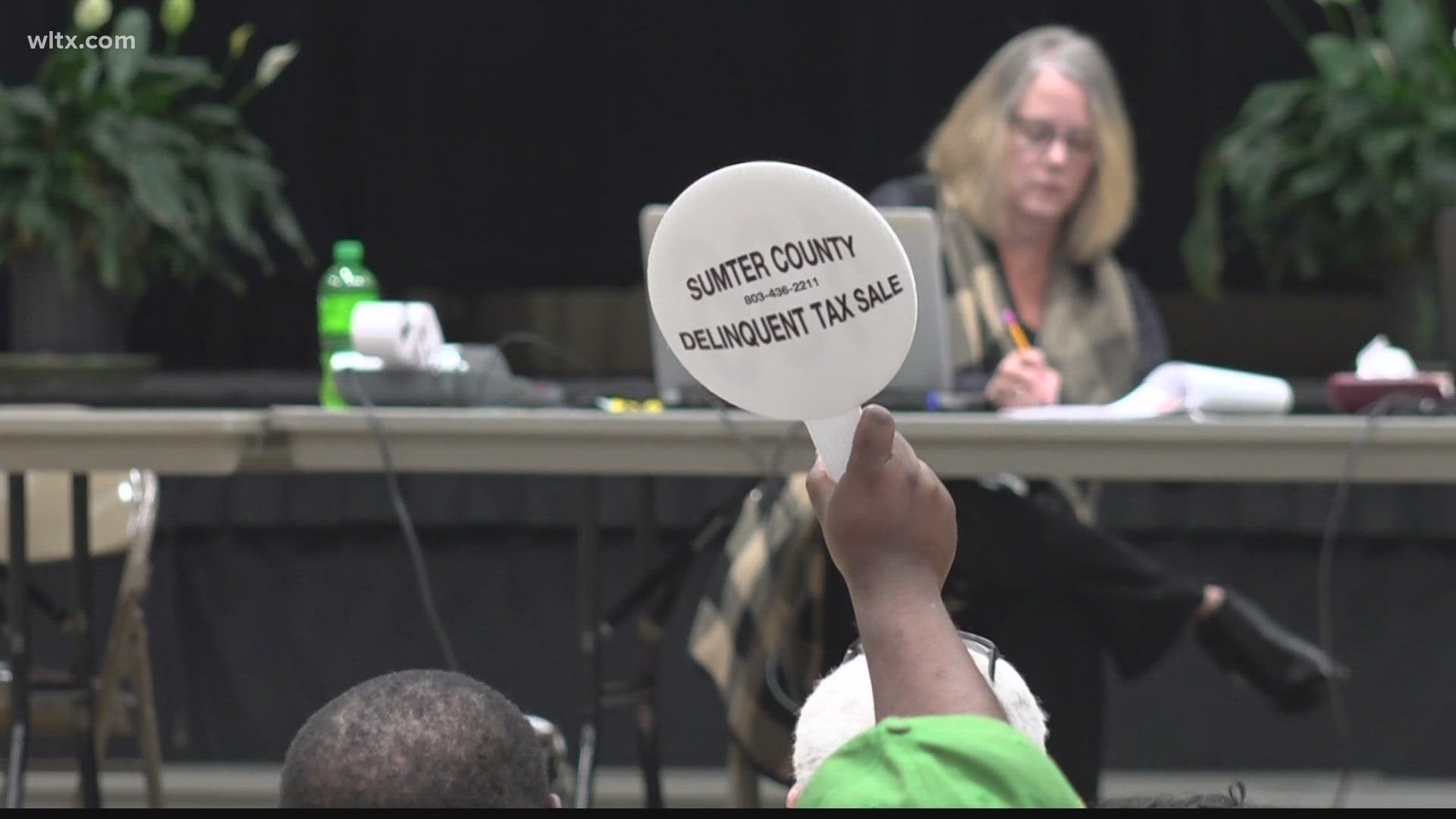

SUMTER, S.C. — Over 500 properties were sold to the highest bidder today in Sumter at the annual Delinquent Sales Tax Auction. Hundreds of residents showed up to try their luck.

“Just because someone else’s trash is trash doesn’t mean it can’t be your treasure,” Sumter resident Morgan Clark says.

It’s the mentality Clark has while trying to buy property at the auction. Clark tells me her plan is to fix up the properties she buys, rent them out and put the money into an account for her daughter and her son, McCoy.

“McCoy would then be able to find a way to pay for his college and my daughter have a way to pay for her college and they’ll be able to be independent and then also have a way to you know make their own business if they would like to continue,” Clark shares.

Leontae Tomlin has a similar plan.

“Rent ‘em out and save them for my daughter,” Tomlin shares. “I feel like it’s the perfect opportunity.”

“The value of this right here, especially for us, is a way to create generational wealth,” James Clark says.

James showed up to the Sumter County Civic Center, grabbed a paddle and bidded on the hundreds of properties that the county has identified, which have not had taxes paid for the 2022 tax year. Some, like Robert Green, find success.

“There’s quite a bit of research that goes into it and just hope for the best basically,” Green shrugs.

“The owner still has a one year redemption period,” Sumter County Chief Deputy Treasurer Yolanda Dixon explains.

Dixon says the property owners had a notice levied on each property before Monday's auction and the properties with delinquent taxes were listed three times in the local newspaper. While these resident properties were auctioned off to the highest bidder, the owner still has a year to get their property back.

“Within that time, whoever bids on the property, they can’t do anything with the property until that one year redemption period is up,” Dixon details.

But then it goes to the bidder, like Mel Evans, who says he has bought 10 properties for $37,000 total. Five of those properties were redeemed by the owner, but Evans says he currently owns two houses and flipped the rest.

“I recommend to anyone and you know my friends and family, they don’t believe me though sometimes,” Evans smiles. “They don’t believe that this process can happen like that.”

If the owner does want to redeem the property, they need to pay all delinquent taxes, assessments, costs, penalties and interest that is being charged for the next year. If the property is redeemed, the successful bidder will get their money back along with a check for their bid amount plus the interest they earn, according to the county.