COLUMBIA, S.C. — Starting October 1, people who provide rooms for rent on websites like AirBnB will be required to electronically file and pay accommodations tax returns.

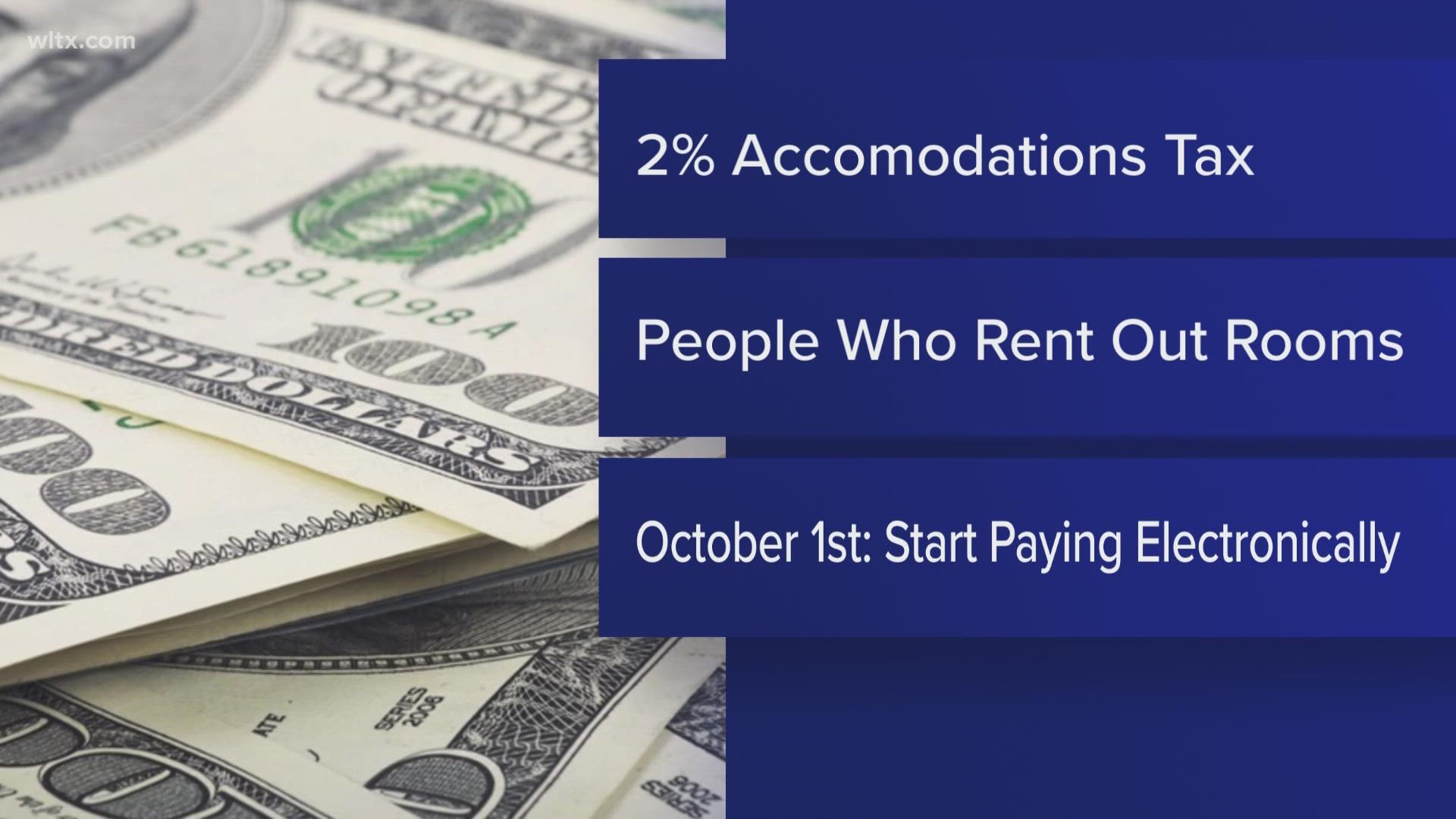

The South Carolina Department of Revenue (SCDOR) wants those who provide tourists and travelers rooms for rent in the state to know about the state Accommodations Tax, a 2% tax added to a 5% Sales Tax and any applicable local tax.

Beginning October 1, 2022, Accommodations Tax account holders will be required to file returns and make payments electronically.

You also must have a retail license to file and pay accommodations taxes if you rent out rooms or spaces in your own home or at hotels, motels, campgrounds, boarding houses or mobile home parks.

Money collected from the accommodations tax is distributed back to cities and counties to be used for tourism, promotion, advertising and other tourism-related activities.

For more information, visit the South Carolina Department of Revenue's website at dor.sc.gov/tax/accommodations.