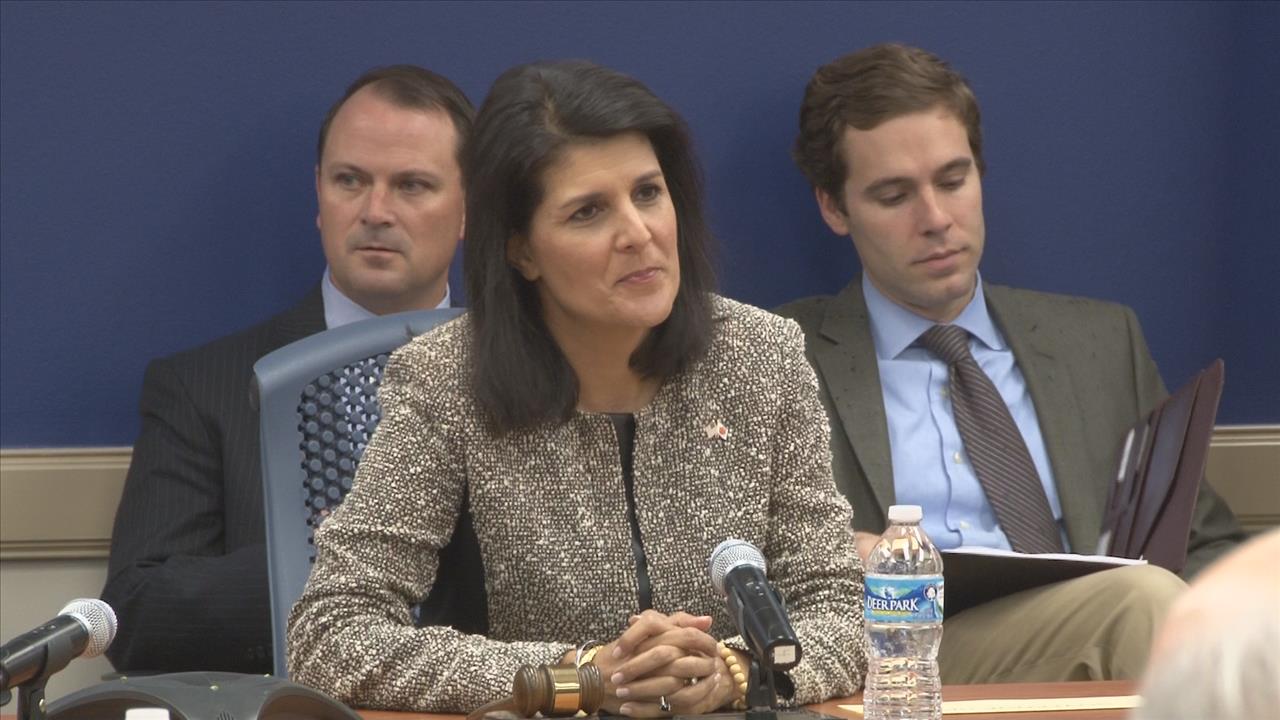

COLUMBIA – The income tax cuts at the heart ofGov. Nikki Haley's 10-year road plan are being assailed by both Democrats and a policy group but for for different reasons.

The Republican governor, however, says that growth and revenues in the state are "jumping" and the state will have no problems paying for the reductions.

"You will find lots of people who say no and why can't we do it and I'll tell you if I had listened to them from day one, we wouldn't be where we are today," Haley said Friday.

Senate Democrats on Friday called the plan a "bait and switch" that will leave more than 1 million taxpayers out of any benefit and raise only a fraction of the revenue necessary for roads. They also said the tax cut could imperil needed government programs and services.

The South Carolina Policy Council, meanwhile, cast doubt on the accuracy of Haley's projections. Ashley Landess, its president, told The Greenville News the state cannot assume revenues for a decade based on hoped-for surpluses and steady gas purchases.

"To try and push 10 years forward and assume growth, to assume no downturn in the economy, is utterly irresponsible and dangerous economically," she said.

Haley proposed to the Legislature Wednesday that the state's 16.75-cents-per-gallon gas tax be raised by 10 cents over three years, provided lawmakers first agree to scrap the current highway commission and reduce the state's income tax from 7 percent to 5 percent over 10 years.

According to figures distributed by her staff Wednesday night, the gas tax increase would produce more than $300 million a year in added infrastructure revenue, while the tax cut would eventually save taxpayers more than $1.7 billion a year. Even with the gas tax increase, according to the figures, taxpayers would still net almost $5.6 billion in savings over 10 years.

Senate Democrats on Friday distributed their own math, showing that over the 10-year span of the plan, the state's infrastructure needs would total $14.7 billion, while revenue from the added gas tax and a diversion from the General Fund would total $3.57 billion.

The tax cut, Democrats say, would total $8.55 billion in that time frame, resulting in less money for education and other state programs.

"The governor is operating under the false premise that you can fund 'hard capital' (roads) at the cost of 'soft capital' (education, etc.)," the Democrats said in a briefing statement. "The first thing an economic development prospect wants to know is, do you have a skilled workforce available. The second is, do you have good roads to transport my goods. Both hard and soft capital are needed in the 21st century — you cannot fund one at the cost of another."

But Haley said she believes annual surpluses will pay for the tax cuts and that taxpayers in the state deserve to be rewarded.

"You can't ignore the surpluses," she said. "And you can't ignore the fact that we have a million new people and are the second (ranked) state that people are moving to. You can't ignore that tourism is up and we're the number one state in the country for international businesses moving in."

Haley said the increase in people and business means more revenue pouring into state coffers.

"We can choose to squander it away and spend it, or we can choose to give it back to the taxpayers," she said. "I'm going to give it back to the taxpayers.

But Landess said the assumptions and promises involved in Haley's projections amount to "voodoo economics." She said one Legislature cannot legally bind another, and future economic downturns, gas price spikes or other unexpected conditions could cause the tax cuts not to materialize.

She said the gas tax increase is being issued in the first three years of the plan, while taxpayers would have to wait until 10 years to realize the full tax reduction.

"If the revenue projections are off, and they most certainly will be, we're not going to see that tax cut," she said.

Republicans have criticized the Department of Transportation's $1.4 billion-a-year projection, saying that it includes much more than maintenance and the fixing of existing roads. Some House leaders have estimated the need is more like $400 million a year.

The Democrats also argue that the income tax reduction plan would grant 379 tax filers who have taxable income more than $2 million with an average benefit of $145,000. More than 1 million filers, many of whom are on fixed incomes, will not pay any tax and therefore not benefit from the tax cut, according to the Democrats.

Those with incomes of between $30,000 and $40,000 would get an average benefit of $948, the Democrats argue.

Haley says the money will be there for the tax cuts and taxpayers deserve the reduction.

"We can pay for this," she said. "There's a lot of people who are going to say, 'no, don't give money back.' You can't look at the fact that we've had an average of $260 million a year in surplus and not say maybe it's time to give this back to the taxpayers before everybody continues to spend it."

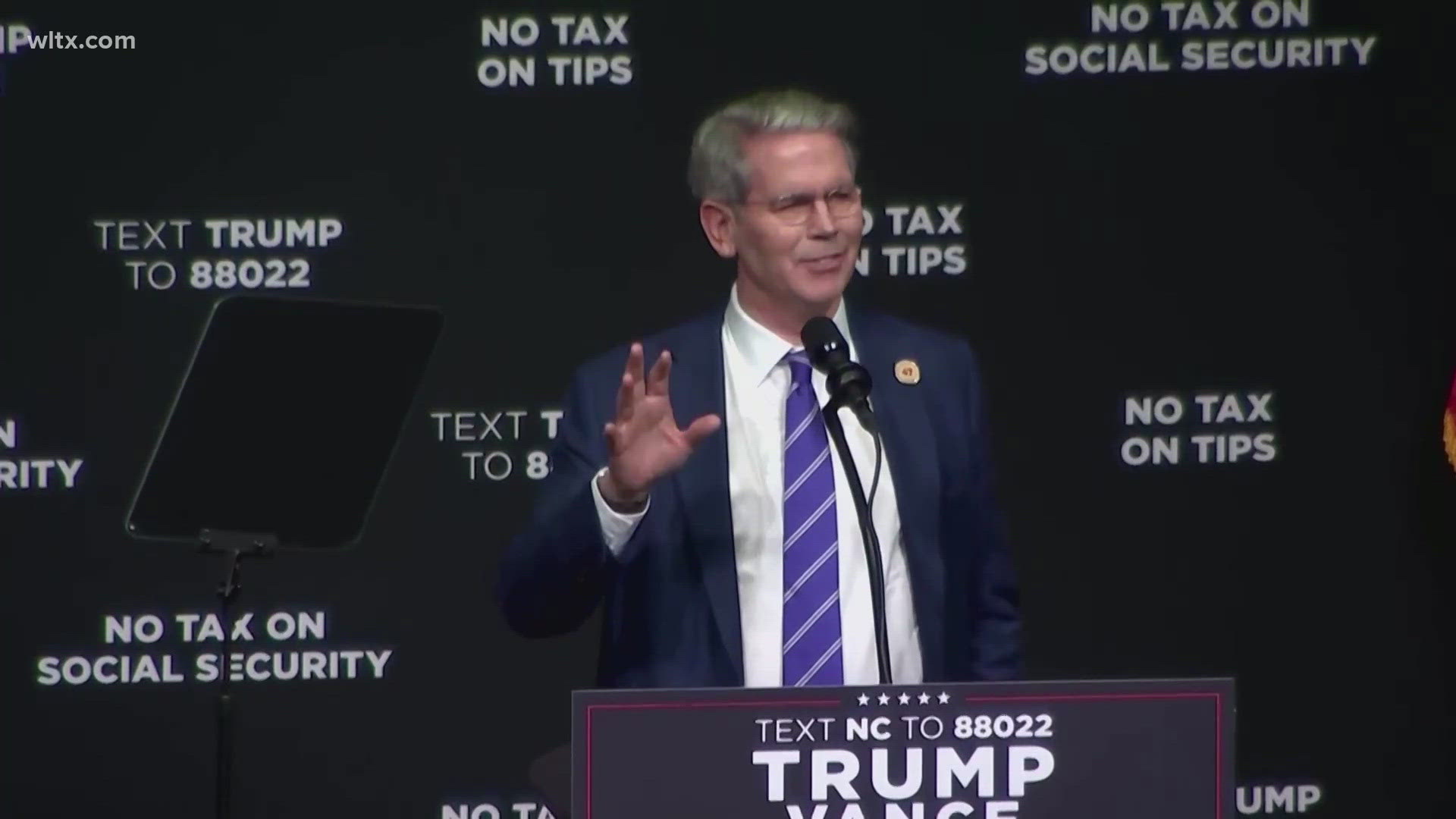

A House infrastructure panel is expected to begin debating legislation to address the roads issue on Tuesday. Its chairman, Rep. GarSimrill of Rock Hill, has said he believes House Republicans will support the elements of Haley's plan, though its leaders want more reforms and he wants to see the numbers on how a reduction in the gas tax and removal of the sales tax exemption on gas would compare in revenues to a straight increase in the fuel tax.

The gas tax has not been raised since 1987 and is one of the lowest in the nation.

Among the questions not yet decided are how the added roads money would be spent.

Haley has asked citizens to contact their lawmakers in support of her plan.

Several business and conservative groups have issued statements in support of the plan or of Haley's efforts.

"While we believe that the recommended 10 cent motor fuel user fee increase in Governor Haley's three-point plan is inadequate to fix our significant and growing statewide infrastructure needs, we appreciate that Governor Haley has listened to the business community and taken a first step to bring this issue to the table," the Charleston Metro Chamber of Commerce said in its statement.