WASHINGTON — With the ongoing war in Ukraine and the U.S. sanctioning Russian oil, the White House has announced plans to release a million barrels of crude oil a day for the next six months from the Strategic Petroleum Reserves.

"Americans are feeling Putin’s gas price hike at the pump," President Joe Biden tweeted Thursday. "That’s why today, I’m authorizing the release of 1 million barrels a day from our Strategic Petroleum Reserve — and taking steps to lay a new foundation for lasting American energy independence through clean energy."

Whether or not this is a good idea really depends on who you ask.

The VERIFY team spoke with Patrick De Haan, head of petroleum analysis at GasBuddy, and Ed Hirs, energy fellow at the University of Houston, to explain how this move will affect the supply of gasoline and the supply of the U.S. stockpile.

What is the purpose of the Strategic Petroleum Reserve?

Like its name suggests, it's about strategy.

"The U.S. strategic reserve is generally there for strategic times — when the flow of oil is kinked in some way," De Haan said. "We've used the SPR to offset major hurricanes when the hurricanes have shut down U.S. oil production. We've also used it during geopolitical tensions, during the Gulf War back in the ’90s. And now today, the president is using it when the flow of oil is is impacted."

Hirs describes the reserve as a stash of crude oil set aside for shortages, disruptions abroad and military purposes.

"The SPR is necessary for us for our military purposes, for being able to project force across the global environment," Hirs said. "Our planes run off of fuel from crude oil; most of our ships do as well."

It's the world's largest supply of emergency crude oil, according to the Department of Energy.

Will releasing 180 million barrels from the SPR over half a year drive down the price of gasoline in the United States?

The president was asked a similar question by a reporter Friday.

"Mr. President, how much, in monetary terms, do you estimate today’s announcement will reduce gas prices? And when can Americans expect to see these changes," the reporter asked.

"That’s a really important question, and there’s no firm answer to it, but prices already came down when it was announced ahead of time..." the president said in part. "My guess is we’ll see it come down — continue to come down. But how far down, I don’t think anyone can tell."

He later said it "could come down fairly significantly" and suggested between 10-35 cents a gallon.

Our experts say driving down gas prices is not as simple as freeing oil from our stockpile.

“Will this release help people at the pump? The answer is maybe," Hirs said. "In order for that price relief to be passed along, we need the full cooperation of Russia and OPEC, not reducing [their] production further.”

De Haan agrees: it’s a global market, so global influences are at play.

"Oil prices are up today on the possibility that the EU could still sanction Russian energy, and that would mean the loss of another 4.5 million barrels of oil per day," De Haan said.

He said the price of oil is largely reliant on the big oil producers: the U.S., Saudi Arabia and Russia.

"So if anything happens in one of the largest oil producers, it can have ripple effects, no matter if it's in the U.S., Russia or Saudi Arabia," De Haan said.

So, our experts say it’s possible prices could dip, but that’s not set in stone.

How will this action impact the Strategic Petroleum Reserve?

Our experts explain selling off 180 million barrels is significant.

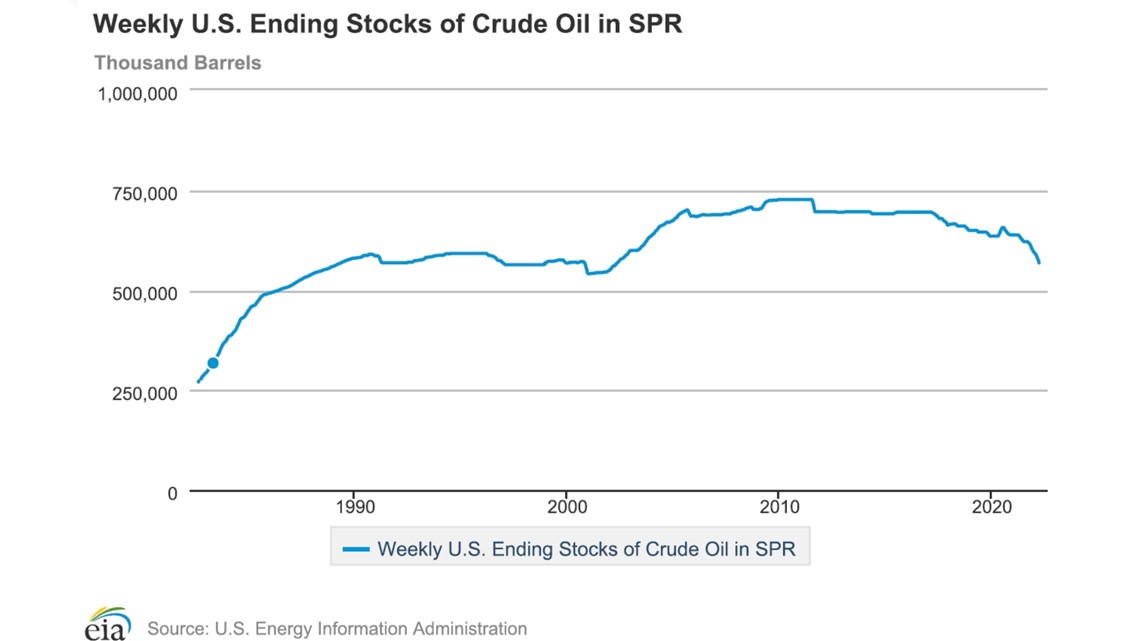

As of Jan. 26, the SPR had about 588 million barrels set aside according to the DOE.

Back in March, the White House announced that it would release 30 million barrels of oil as part of a joint release with the International Energy Agency.

A White House spokesperson confirmed to VERIFY that the 30 million barrel release is "happening right now" and deliveries will go through the end of May.

The Department of Energy provided this timeline online:

- March 8 - bids were received

- March 17 - contracts awarded

- March 1-May 31 - deliveries made

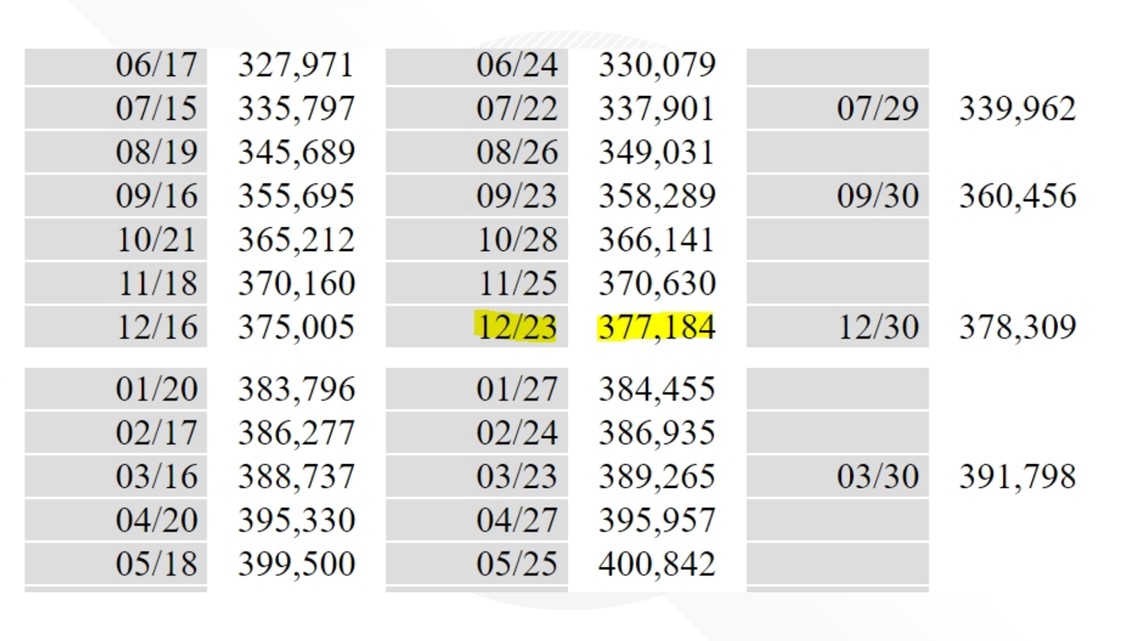

So, with this latest news of selling off 180 million barrels over six months, that will put our reserves below 400 million barrels.

It has not been that low since the end of 1983, according to data from the U.S. Energy Information Administration. On Dec. 23, 1983 there were about 377.2 million barrels.

Hirs called the move "short-sighted."

"We could have a situation later this summer where supply chains for oil across the globe are severely disrupted," Hirs said. "And we may be really needing that oil at some point to maintain a strong domestic economy and maintain a strong military and will be significantly weaker just to pump out some oil today to placate voters.”

"Uncomfortable," is how De Haan put it.

"The SPR has almost always — since its inception — has had far more oil in it," he said. "So it does leave the U.S. at greater risk if there is another disruption.”