COLUMBIA, S.C. — Recently, the Federal Reserve, often called the “Fed,” was tasked with figuring out how vulnerable big banks are to climate change. The Fed released a climate risk analysis last week and is now asking American banks whether they are prepared.

Six major banks are participating in this survey: Bank of America, Citigroup, Wells Fargo, JPMorgan Chase, Goldman Sachs, and Morgan Stanley.

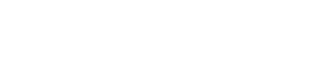

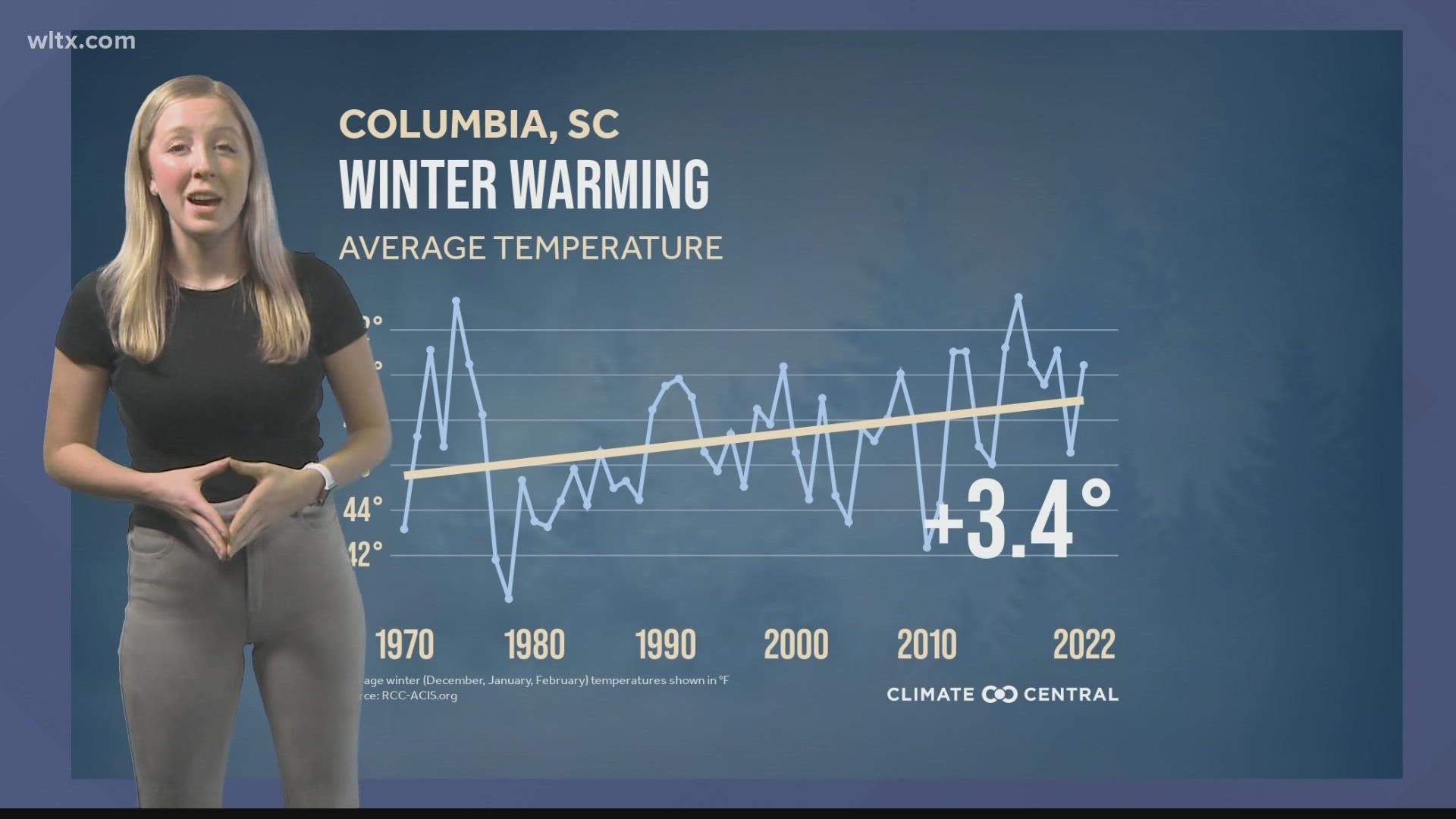

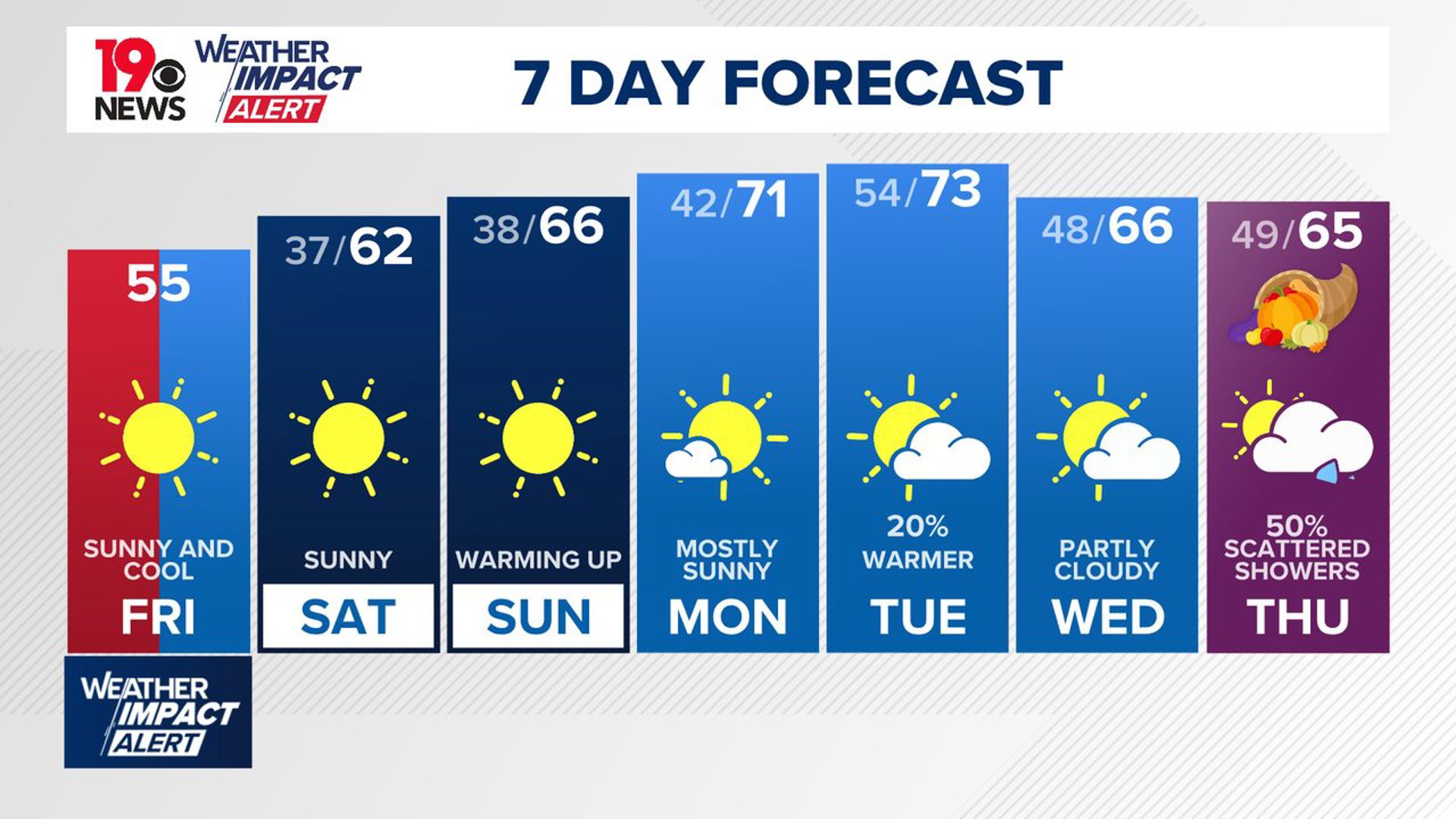

The first exercise for them is to look at physical risks. If natural disasters continue to occur more frequently, the Fed wants banks to pay attention to real estate portfolios since homes and property could be vulnerable to shifting climate.

According to Grist magazine, the Fed is asking how many residential and commercial loans would fall through and how much money would it cost the banks if disasters happened.”

Transitional risks are the second exercise. If the world came together and transitioned away from fossil fuels, major oil companies and other carbon-intensive companies would see severe losses, states The Grist.

And in turn, America’s biggest banks would suffer. Advocacy group, Reclaim Finance, reports “five of the six participating banks are major backers of fossil fuels.”

The Federal Reserve has asked banks to submit their responses by the end of July 2023.